Our Service

Member

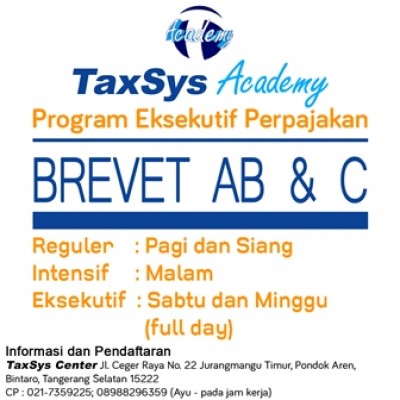

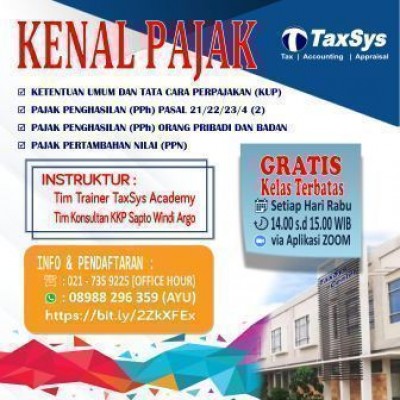

Training Partner

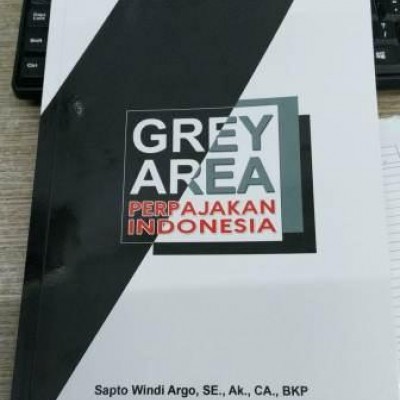

Consulting Partner

Recent Topics

Bisakah kita menginput banyak pegawai dalam sekali import?

Bisa

di E SPT sudah disiapkan fasilitas tersebut

Pelaku UMKM yang terkena 0,5% kenapa masih di potong 2% oleh bendahara?

UMKM perlu surat yang memberitahukan bahwa UMKM tersebut kena 0.5%

surat tersebut diberikan ke pada bendahara

perubahan PPh Badan

kapan terakhir e SPT PPh Badan ter update?

batas lapor

tanggal berapa terakhir lapor OP?

Our News

Development of the Implementation of Value Added Tax (VAT) in Trading Transactions Through Electronic Systems (PMSE) in Indonesia

Cooming soon...

Comparative Study of Foreign Airline and Shipping Tariffs in Indonesia with ASEAN Countries

Cooming soon...

Penelitian BPHTB dan SPTPD Pajak Daerah

Pemeriksaan pajak daerah, penelitian BPHTB, dan penelitian SPTPD memiliki karakteristik dan tujuan yang berbeda namun saling melengkapi dalam upaya pengawasan dan optimalisasi penerimaan pajak daerah.