Our Service

Member

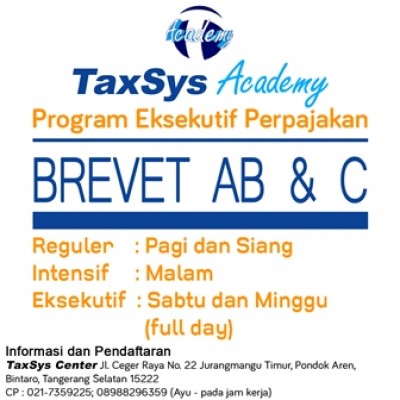

Training Partner

Consulting Partner

Recent Topics

Bisakah kita menginput banyak pegawai dalam sekali import?

Pelaku UMKM yang terkena 0,5% kenapa masih di potong 2% oleh bendahara?

perubahan PPh Badan

batas lapor

Our News

Penelitian BPHTB dan SPTPD Pajak Daerah

Pemeriksaan pajak daerah, penelitian BPHTB, dan penelitian SPTPD memiliki karakteristik dan tujuan yang berbeda namun saling melengkapi dalam upaya pengawasan dan optimalisasi penerimaan pajak daerah.

STPD and Tax Collection

As we know, apart from the Tax Assessment Letter and SPPT, the basis for tax collection also includes SKPDKB, SKPDKBT, Correction Decree, Objection Decree. Therefore, if the STPD is not paid for the legal product, it will result in a re-determination of the same object. The PPSP Law stipulates that the authority to appoint officials to collect regional taxes is given to the Regional Head. What is meant by an official for collecting regional taxes is, for example, the Head of the Regional Revenue Service. Officials in the field of tax collection are given the authority to appoint and dismiss Tax Bailiffs, issue Warning Letters, Warning Letters or other similar letters, Immediate and Simultaneous Collection Orders, Forced Letters, Orders to Execute Confiscations, Hostage Taking Orders, Letters of Revocation of Confiscation, Announcements Auction, Limit Price Determination Letter, Cancellation of Auction, or issuing other letters. Other letters required for tax collection include a letter requesting the date and time schedule for the auction to the auction office, a letter requesting a Land Registration Certificate (SKPT) to the National Land Agency/Land Office, a letter requesting assistance to the police or a letter requesting prevention. From the description of the collection process above, there is no room for issuing a new assessment in the form of a Regional Tax Bill in the collection process due to non-payment of the tax debt. Tax debts that are not or underpaid will be collected based on the process regulated in the Law on Tax Collection with Forced Letters where the initial effort is a letter of reprimand, warning or other similar letter which is not a determination in an effort to collect before the forced letter is issued. The next process is a collection effort through a forced letter, followed by confiscation and auction until the tax debt is paid off.

STPD and the Risk of Multiplication of Arrears

Regional taxes and regional levies are an important source of regional income to finance the implementation of regional government. One of the provisions regulated in the KUPDRD is the issuance of a Regional Tax Bill, one of the reasons for which is the Tax payable in the Regional Tax Assessment Letter (SKPD) or Tax Payable Notice (SPPT), Correction Decree, Objection Decree, and Appeal Decision. not or underpaid after payment is due.